likelihood of capital gains tax increase in 2021

The lifetime capital gains exemption is. It would also nearly double taxes on capital gains to 396 for people earning more than 1 million.

Congress Readies New Round Of Tax Increases Freeman Law Jdsupra

The Covid-19 crisis has exacerbated the need to raise additional tax revenues and an increase in CGT rates wont break the governments.

. That would be the highest tax rate on investment gains which are mostly. The Chancellor will announce the next Budget on 3 March 2021. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. Likelihood of capital gains tax increase in 2021 Tuesday June 14 2022 Edit.

Many speculate that he will increase the rates of capital. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. Note that short-term capital gains taxes are even higher.

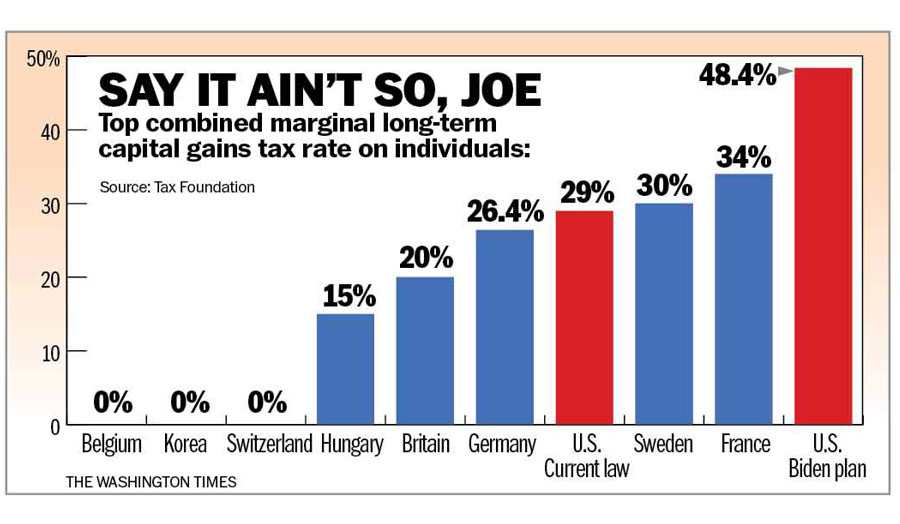

Various media reports indicate the president will propose taxing capital gains at the top ordinary tax rate which would be 434 when including the current 38 on net. The current capital gain tax rate for wealthy investors is 20. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396.

Capital gains tax is likely to rise to near 28. Apr 23 2021 305 AM. Implications for business owners.

Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to. Assume the Federal capital gains tax rate in 2026 becomes 28. While it is unknown what the final legislation may contain the elimination of a rate.

Published on 22nd Jan 2021. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Capital Gains Tax 101 Selling Stock How Capital Gains Are Taxed The Motley Fool.

Managing Tax Rate Uncertainty Russell Investments

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

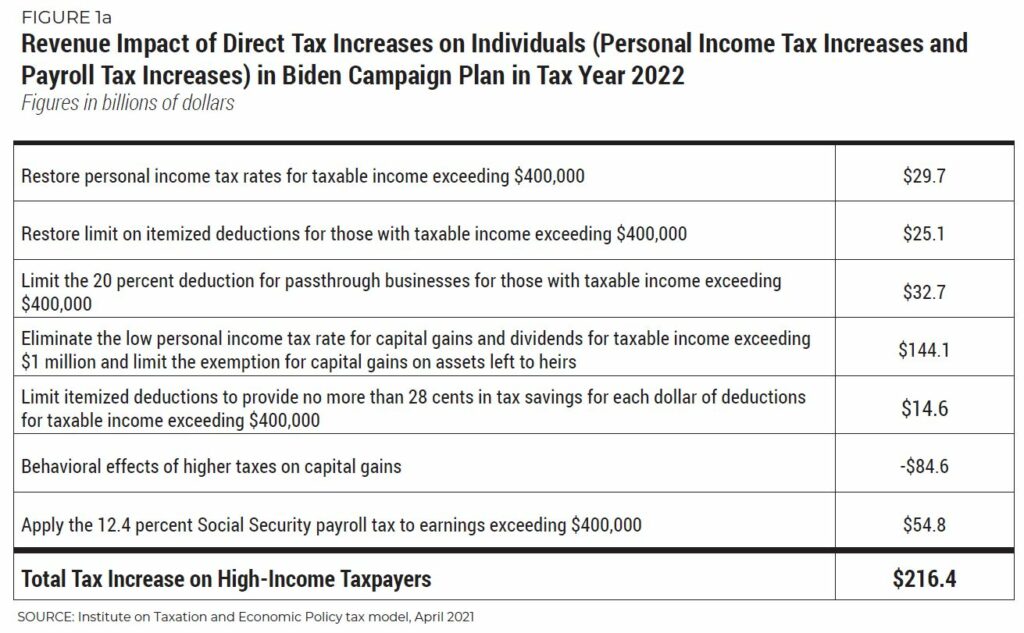

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

September 13 2021 Update Democrats Propose New Tax Increases Srs

New Tax Initiatives Could Be Unveiled Commerce Trust Company

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

How The Biden Tax Plan Will Impact The Economy

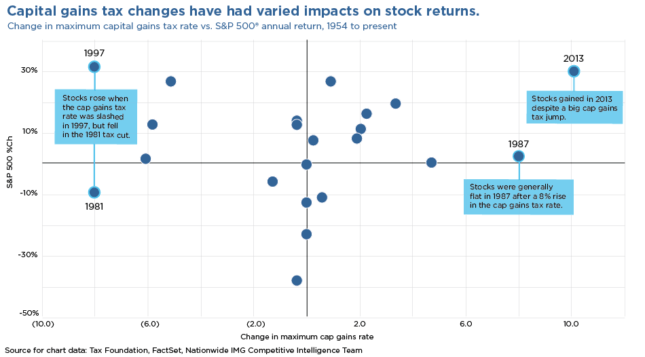

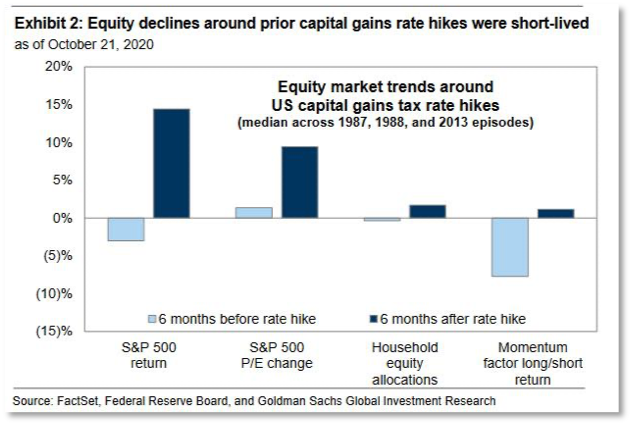

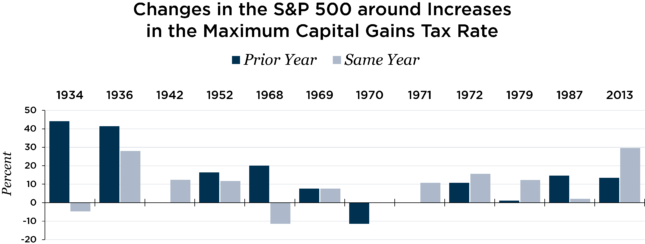

Stocks Retreat On Capital Gains Plan Nationwide Financial

Biden Capital Gains Tax Rate Would Be Highest In Oecd

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Capital Gains Tax Hike And More May Come Just After Labor Day

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

Inflation Coupled With Democrats Proposed Tax Increases Are A Recipe For Disaster Washington Times